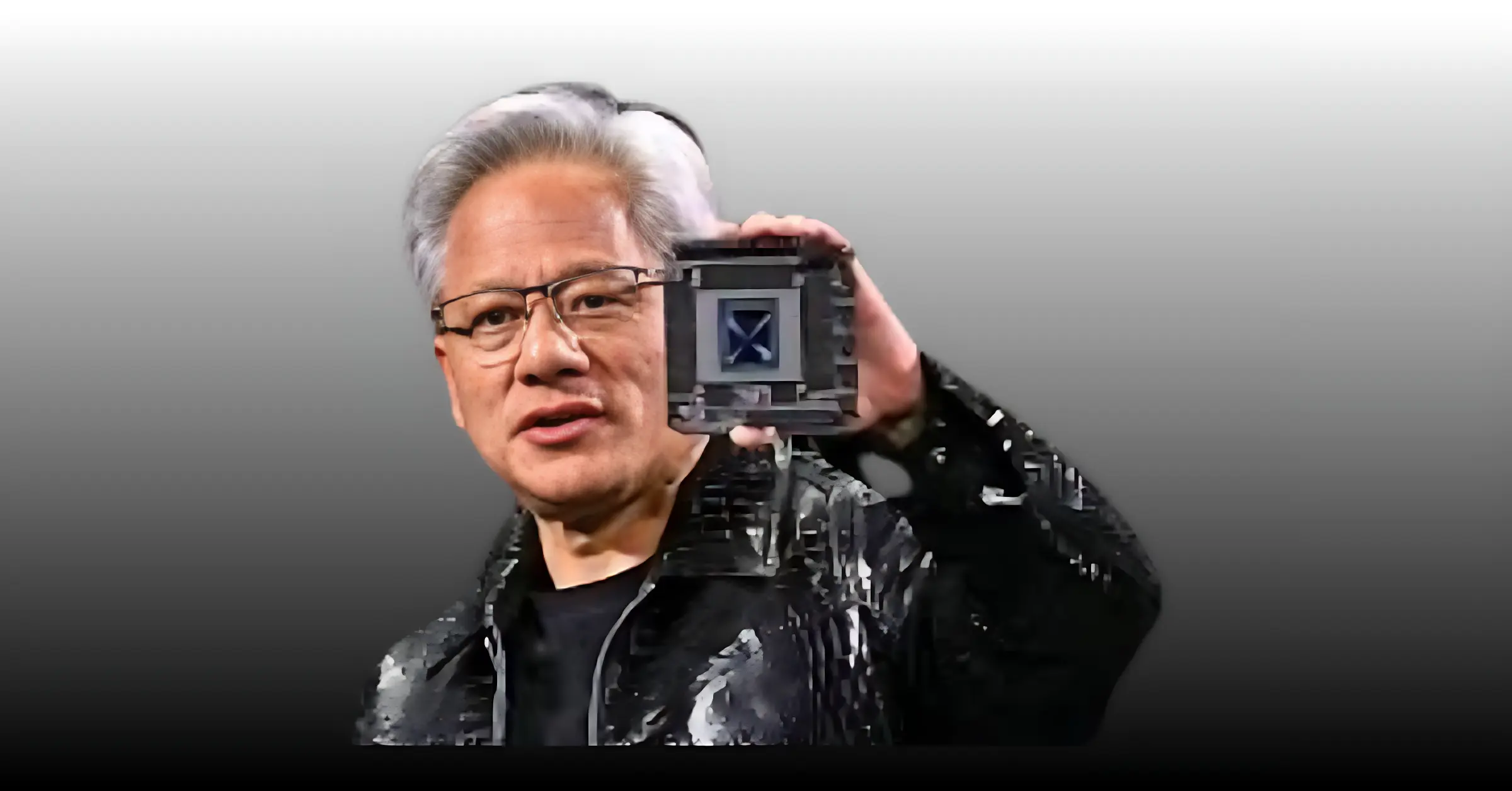

Nvidia ceo jensen huang

Nvidia’s China market was wiped out overnight: Jensen Huang says the US ban reduced AI GPU share from 95% to zero.

Nvidia CEO Jensen Huang has revealed a stunning decline in the company’s presence in China’s AI chip market after strict US export controls were imposed, falling from a 95% share of the total to zero.

Speaking at Citadel Securities’ Future of Global Markets 2025 event in New York on October 6, Huang didn’t mince words. “Right now, we are 100% out of China,” he said. “We went from 95% market share to 0%.” The comments underscore how dramatically US sanctions have reshaped the global AI hardware landscape.

Citadel Securities later published the full interview on YouTube, marking the first time that Nvidia has publicly laid out the extent of its withdrawal from China. While Huang didn’t mention specific chips, he was apparently referring to Nvidia’s data center GPU lineup—the backbone of the world’s AI computing power.

New export restrictions have repeatedly hit Nvidia’s China-bound GPUs since the end of 2022. The A800 and H800 models—modified versions of the company’s powerful AI chips that were previously designed to comply with US regulations—will become non-compliant due to tighter restrictions later in 2023. Even the new H20 chip has faced licensing challenges, effectively turning Nvidia off from its Chinese customers.

Huang expressed disappointment at the outcome, saying, “I can’t imagine that any policymaker would think this is a good idea—that the US loses 0% of one of the world’s largest markets because of every policy we implemented.”

For context, China previously accounted for 20% to 25% of Nvidia’s data center revenue—a business segment that brought in more than $41 billion in the company’s latest fiscal year, representing a 56% increase over the previous year. Nvidia’s data centers play a pivotal role in driving the significant AI boom across various industries. Losing access to a big market like China could have a significant impact on future growth.

The US government has steadily tightened export rules on advanced AI chips sold to China, aimed at limiting Beijing’s access to top-tier semiconductors used in artificial intelligence and supercomputing. But as Huang noted, those measures have had dramatic side effects. “In all our forecasts … we are assuming 0% for China,” he said. “If anything happens in China… it will be a bonus.”

Nvidia’s new reality also reflects a larger global shift. China’s major tech companies and AI research labs are now racing to create domestic alternatives. Local chipmakers are stepping in to fill the gap, developing new AI processors and expanding data center infrastructure—a push that could ultimately create a self-reliant Chinese AI ecosystem.

Huang has previously warned that violating sanctions could backfire by encouraging China’s efforts to innovate faster. Earlier this year, he said that the more barriers the US government erects, the more incentive Chinese companies will have to produce competing domestic technologies.

Despite the dire figures, Huang remains cautiously optimistic that Nvidia could someday return to China’s AI market—though not any time soon. For now, the company’s forecasts officially project zero sales from China, a stunning reversal for a tech giant that once dominated the region’s AI hardware industry.

As Nvidia turns its attention to the US, Europe, and other markets, one thing is clear: Washington’s export controls have completely redrawn the AI battlefield—and Nvidia’s sudden decline in China shows how quickly fortunes can change in the global tech race.

Nvidia’s retreat from China is more than just a business setback—it’s a sign of how geopolitics is redrawing the map of global technology. The company’s fall from 95% to 0% market share highlights the powerful impact of export bans and political decisions on even the most advanced industries.

While Nvidia continues to thrive in Western markets, the loss of China—once a cornerstone of its growth—leaves a major void. Meanwhile, China is doubling down on homegrown chip development, determined to reduce its dependence on American technology.

For now, Jensen Huang remains cautiously optimistic, saying that any future success in China would be “a bonus.” But the bigger story is clear: the battle for AI chip dominance has entered a new phase, one defined not just by innovation but by national strategy and global rivalry.